The Scar From Which The Construction Workforce Has Yet To Recover

Construction of Seattle’s Space Needle, 1961 (source).

One way to gauge the severity of the construction labor shortage in different places is to observe where job postings remain online for longer, suggesting greater difficulty filling jobs.

Job posting data indicate that the relative severity of the shortage is greater in expensive states such as Massachusetts, New Jersey, and California, although it is also severe in a few lower cost states, such as Pennsylvania and Michigan.

Although construction employment rates have recovered to pre-bust levels circa 2005, the size of the construction workforce has diminished since then, both nationally and in most states.

The current severity of the shortage in different states corresponds to the decline in the ranks of young construction workers, but not the overall construction workforce.

States whose home values were hit harder by the bust incurred greater declines in the share of young construction workers, yet states whose home values have recovered more vigorously have failed to see a corresponding recovery in the share of young workers.

Home construction in the U.S. has been recovering from the housing bust since the early 2010s, but the recovery has been sluggish and there are still fewer homes being built each year than was the historical norm. Homebuilders and economists explain the sluggish recovery in terms of “Labor, Lots and Lumber,” referring to the shortage of construction labor, the difficulty of obtaining land for development in sought-after areas, and the rising cost of building materials. Although labor, lots and lumber are all important, labor tends to draw the most attention.

Although it is well-known that a shortage of construction labor exists, its relative severity across the U.S. remains unclear. Measuring the intensity of a shortage requires one to observe unmet demand, and one way of gauging a shortage that involves labor is to observe the difficulty of hiring workers. This study uses data about online construction job-postings provided by Greenwich.HR, a labor market intelligence firm, in order to observe the share of job-postings that remain online for an extended period of time (see Data and Methodology section for details).

The bar chart ranks states by their “45-day construction job-posting survival rate” in 2017, i.e. by the share of construction job-postings that remain online after 45 days.[1] Per this measure, the shortage of construction labor is most severe in Massachusetts, followed by New Jersey, California, Pennsylvania and Connecticut. The mildest shortage–if it can still be referred to accurately as a shortage–is in Mississippi, followed by Idaho, Wyoming, Kentucky, and Louisiana.[2]

Download the data in the charts

The Shortage of Construction Labor Is More Severe in the Pricier States

The top of the list appears to be dominated by expensive coastal states, in which both the cost of living and the value of real estate are high. The upward slope of the fitted line in the graph above, which plots the 45-day survival rate against median home values, confirms that on average the shortage of construction labor is, in fact, greater in states whose housing is more pricey.[3]

Why is this so? The web of interactions is more complicated than it may seem at first glance.

First, high housing prices make the construction labor market tighter, i.e. short of construction workers, by reducing the supply of construction workers and increasing the demand for them. They make it harder to maintain jobs at typical construction wage levels, thereby reducing supply. All else equal, they also increase demand by weeding out people and firms that are less well-to-do, and who therefore require construction services less intensively and less frequently than those who remain (bear in mind that construction workers engage in the maintenance and renovation of existing properties, in addition to new construction).

Secondly, going in the opposite direction, a greater shortage of construction workers helps raise housing prices by raising the duration and cost of construction. Indeed, a chronic relative shortage of construction labor in America’s expensive coastal cities could add an additional layer of explanation–among others–for these areas’ long-run deficit of housing production.[4]

Finally, and perhaps most importantly, some of the same forces that make housing expensive also make the labor market tight, irrespective of the two actually affecting each other–a case of correlation without causation. Large metropolitan areas and states don’t usually become expensive unless they have a vibrant economy that generates strong demand across the board. When such demand is difficult to satisfy, intense competition ensues for space–especially for housing–and for labor (as well as other non-tradable goods and services). Such competition results in higher home prices, as well as a mixture of higher wages and greater difficulty in filling jobs–and we have our chart.

The greater relative shortage of construction labor in expensive states is likely to be a longstanding feature of the US economy. Although housing price differences across states change somewhat from year to year, broad differences such as the fact that the coasts are pricier than the south and the midwest are slow to change. California’s housing prices, for example, have been diverging from the rest of the nation’s since the 1970s. Given the ties outlined above, the relationship between the high cost of housing and the relative shortage of construction labor is likely to persist.

However, not all expensive states exhibit as severe a shortage as others, and some states such as Pennsylvania and Michigan exhibit a relatively severe shortage of construction labor despite being less pricey. Indeed, housing price levels account for only about 40 percent of the cross-state variation in the 45-day job-posting survival rate, leaving plenty of scope for other factors to help explain the geography of the shortage.

The Employment Rate Of Construction Workers Has Recovered From The Housing Bust, Nationally And In Most States, But The Construction Workforce Has Greatly Diminished

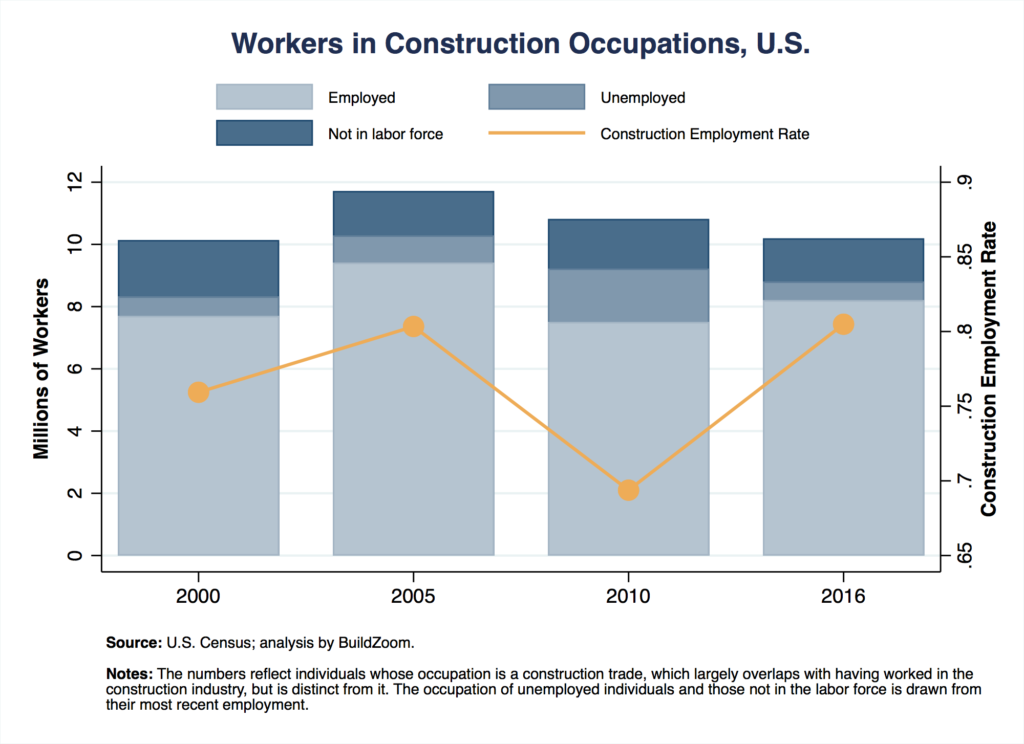

Nationally, the employment rate of construction workers has fully recovered from its tumble during the housing bust, but the construction workforce has substantially diminished. The following chart shows the number of workers in construction occupations and breaks down the employed, unemployed and not-in-labor-force components. The employment rate fell from 80.3 percent in 2005 to just 69.4 percent in 2010, but by 2016 it had risen to 80.5 percent.[5] At the same time, the housing bust left a more permanent scar in the form of a diminished construction workforce. From a high of 11.7 million in 2005, it fell to 10.8 million in 2010 and–despite the recovery in the years since–it kept falling thereafter, to as little as 10.2 million in 2016.

The same pattern of employment rate recovery and workforce decline holds at the state level. Construction employment rates have more or less climbed back to pre-bust levels, but the number of construction workers has substantially diminished compared to 2005 in all but a few states. Among the majority of states whose construction workforce declined, Nevada tops the list followed by Idaho and Arizona, but deep losses of construction labor have been far more widespread. Despite a 9.4 percent increase in the U.S. population from 2005 to 2016, as many as 41 states saw their construction workforce decline, 34 states lost more than 10 percent of their construction workforce, and 15 states lost more than 20 percent. Among the handful of states whose construction workforce has grown since 2005, Texas is the only heavily populated example, and even so, its construction workforce growth (10.2 percent) fell short of its general population growth (22.5 percent).

In States Whose Home Values Fared Worse During The Bust, Construction Labor Declined More Sharply

The pair of charts above plots the change in construction labor against the corresponding change in median home values, for 2005-2010 on the left and for 2010-2016 on the right.

According to the 2005-2010 chart, states whose home values fell more sharply during the bust, such as Nevada, Arizona, California and Florida, also experienced greater declines in their construction workforce, on average, and vice versa. These states’ housing markets were the most buoyant during the boom, so it is not surprising that their construction workforce took a greater hit than others’ when the bust arrived and new construction ground to a halt. In contrast, the 2010-2016 chart shows that the construction workforce in states whose housing prices recovered more vigorously in recent years has not fared any differently than elsewhere (the fitted line in the righthand chart slopes slightly upward, but it is only weakly statistically distinguishable from a flat line).[6] This chart also indicates substantial variation across states in the decline or growth of their construction workforce. Although some states, including Colorado and Texas, have seen their construction workforce grow since 2010, most states, as well as the nation as a whole have seen continued decline despite the housing market recovery.

States Whose Home Values Were Hit Harder In The Bust Also Lost A Disproportionately Large Share of Young Workers

The skills required in the construction trades require formal training, but they also require many years to hone with experience on the job. As a result, young workers whose skills and experience were less valuable were probably more likely to lose construction jobs during the bust than their older counterparts. This is consistent with observing that the states hit hardest by the housing bust also experienced the greatest declines in young workers’ share of the construction workforce, and that is in fact what we observe.[7]

The pair of charts, above, shows the change in young workers’ share of the construction workforce, from 2005 to 2010 on the left and from 2010 to 2016 on the right. Once again, the fitted line in the 2005-2010 chart has an upward slope, indicating that states whose home values fell the most during the bust also saw, on average, the greatest decrease in young workers’ share of the construction workforce.

The 2010-2016 chart essentially shows a flat line, meaning that on average the extent of housing market recovery bears no relation to changes in young workers’ share. The chart does show that a number of states, including New Jersey, Florida, and Oregon, have seen increases in the young workers’ share since 2010. But when the period from 2005 to 2016 is taken as a whole, as shown in the bar chart below, all but two states have seen their young workers’ share decline.

Today’s Construction Labor Shortage Is More Severe In States Whose Ranks Of Young Workers Took A Blow, But Is Unrelated To The General Construction Workforce Decline

Although the states hit hardest by the housing bust had greater construction workforce declines both in general and with respect to the share of younger workers, it is the latter that appears to be crucial with respect to the current labor shortage. The last pair of charts plots the 2017 construction job-posting survival rate, i.e. our measure of the relative severity of construction labor shortage, against the 2005-2016 change in the size of the general construction workforce on the left, and the corresponding change in younger workers’ share of the workforce on the right. Whereas the fitted line on the left is flat, indicating the absence of a relationship, the one on the right slopes downward, which means that states whose young workers’ share of the workforce fell more sharply from 2005 to 2016 have more severe shortages of construction labor today. The result is shown using the entire 2005 to 2016 period, but it is driven primarily by the 2005 to 2010 period, not 2010 to 2016.

The Housing Recovery Is Failing To Undo The Prior Damage To The Ranks Of Young Workers

The current shortage of construction labor appears to be driven by the loss of young workers during the housing bust–a scar from which the construction industry has yet to recover. The chart on the right, which was already shown earlier, is particularly revealing because it tells us that states whose home values recovered more vigorously since in the last few years have failed to see a corresponding recovery in the share of young workers. Whereas the reduction in home values during the bust years did a great deal of damage to the construction industry’s numbers, their recovery since then has done very little to undo the prior damage.

Why aren’t young workers flocking back to the construction industry? There is no obvious answer, but one possibility is that the formal training required in the construction trades is harder to come by today than it was before the housing bust. This could be because of the loss of institutions such as high-school vocational training programs and technical colleges during the bust. The evidence of such institutions shutting down during the bust is anecdotal, but it would be no surprise if it turned out that such institutions closed down more often in states that were harder hit.

Another possibility is that young workers often enter construction following the footsteps of slightly older relatives and friends. The decline in construction labor during the housing bust, especially among the younger ranks, left fewer young construction workers to reel in the next generation (economists would call this a “propagation mechanism” for the initial labor supply shock that the housing bust delivered).

Will The Construction Workforce Recover?

The housing bust has left a permanent scar on the ranks of an entire generation of young construction workers. Because the process of becoming highly-skilled construction workers takes a great deal of time, rebuilding the construction workforce will take time as well. But, unfortunately, the process of rebuilding doesn’t show up in the data yet.

Regardless of the housing bust, the construction industry has long suffered from a broader, long-term challenge in marketing itself to younger generations–as have blue-collar jobs in general. The blow dealt by the housing bust affected the industry above and beyond this broader trend, but rebuilding the construction workforce (and building more housing) requires addressing both.

Immigration could provide a potential labor pool that would at once be less susceptible to the way in which construction occupations are perceived, and which may already possess much relevant experience. However, given the current political environment in the U.S., it is difficult to imagine a massive influx of trained construction labor.

Which brings me to technological change. Despite much talk of disruption in the construction industry, the substantial technological innovation that would reduce the need for skilled construction workers has yet to materialize at scale. In the meantime, the hype surrounding anticipated technological advances in construction casts doubt on the long-run prospects of entering the construction trades and may be yet another factor that helps deter young workers from entering the industry. None of this is to say that technological progress won’t ultimately save the day–it probably will, gradually–but for the time being it appears that construction labor will continue to be in short supply.

Notes:

1. The choice of a 45-day period is inconsequential to the analysis. See Data and Methodology section for details.

2. Because jobs take time to fill even when labor is abundant, there is no specific survival rate that distinguishes shortage from sufficiency or surplus, but we can still speak of shortage in relative terms.

3. The slope is greater than zero at the 99% confidence level.

4. Taken together with the influence of high housing costs on the tightness of the construction labor market, the effect of a chronic construction labor shortage on construction costs and thereby housing prices can jointly form a positive feedback loop.

5. The employment rate, also known as the employment-to-population ratio or “epop,” is a broad measure of workforce participation that doesn’t distinguish between the unemployed and those who are not in the labor force.

6. The slope is statistically different than zero only slightly below a 10 percent significance level, but not at the standard 5 percent significance level.

7. To see why, consider a simple example: suppose states A and B each have 10 construction workers each, of which 5 are young and 5 are old, and suppose that when a worker must be laid off, a young worker is twice as likely to be selected for the layoff as an older one. State A loses 3 construction jobs, so it can expect to lose 2 young workers and 1 older worker, resulting in a new headcount of 3 young workers and 4 older ones–a 7.1 percent reduction in the young workers’ share. State B loses 6 construction jobs, so it can expect to lose 4 younger workers and 2 older workers, resulting in a headcount of 1 younger worker and 3 older ones–a 25 percent reduction in the young workers’ share.

Data and Methodology:

Online construction job posting duration data: this data was kindly provided by Greenwich.HR, which aggregates them from a broad variety of online sources. Job postings are revisited on a daily basis. Among other things, Greenwich.HR records the date on which job postings are first and last observed online.

Identification of construction job postings: Greenwich.HR assigns job postings to the “construction and trades” vertical when they correspond to a firm in the construction industry, as per its industry classification (Dun and Bradstreet or equivalent) or when they correspond to a construction occupation, as indicated by the appearance of certain keywords.

Representativeness:

Online job postings are likely to differ from those found offline. However, as of 2017–the period observed using this data–it seems reasonable to assume that the set of online construction job postings comprises a large enough share of all job postings to be of interest in its own right, and to offer an imperfect but meaningful approximation of trends among all construction job postings. The scope of this study is strictly limited to job postings found online.

The key concern with respect to the data is whether they are similarly representative across states, so that they allow for apples-to-apples cross-state comparisons. In order to gain confidence that the representativeness of the data is at least roughly similar across states, we inquired whether the number of job postings observed in each state in 2017 was proportional to the size of that state’s construction workforce. There is no reason to think the two measures will be precisely proportional across states–they almost surely never will be–but both are determined primarily by states’ populations, and only secondarily by other factors (in econometric terms, the two measures are cointegrated). If the Greenwich.HR data presented vastly different construction job-posting to workforce ratios across states, that would suggest the data’s coverage–and presumably representativeness–of job postings differed greatly across states, but the following chart illustrates that this is not the case.

The chart indicates that the ratio of construction job postings to workforce size in each state in 2017 was roughly constant, around 4.8 job postings per 100 construction workers (including those not in the labor force). Given that not every job involves a posting–some workers are hired less formally, especially in an industry with a long tail of small firms–and that some job postings remain offline, this number is reasonable. It suggests that even if Greenwich.HR is not obtaining every single online job posting, it is obtaining a sizable share of them. More importantly, it is obtaining a roughly similar share across states, suggesting that the representativeness of the data are likely to be roughly similar across states, which relaxes our main concern.

Choice of a 45-day period for the survival-rate measure: this choice is ultimately arbitrary, but also inconsequential, as it is the cross-sectional comparison of survival rates across states that matters, not the levels. The survival function for 2017 construction job postings observed in the data is as follows:

Note that observing the 45-day survival rate for all jobs posted in 2017 requires observing at least the first 45 days of 2018. The data used for this study span the entire first quarter of 2018.

2. Construction workforce data: this data was obtained from the U.S. Census–specifically the 2000 Decennial Census and the 2005, 2010 and 2016 1-year American Community Surveys–via the University of Minnesota’s IPUMS-USA system.

3. Housing price data: this data was obtained from Zillow, in the form of monthly Zillow Home Value Index levels. Annual levels were obtained by averaging across months.